Insurance & Payments

As part of our commitment to being your provider of choice, Dakota Family Services works closely with patients, their families, and insurance companies to determine all possible payment options.

For answers to specific insurance and billing questions, please call 701-551-7015.

Insurances Accepted

Dakota Family Services is an “in-network” provider for the following insurance plans:

- U.S. Department of Veterans Affairs

- Blue Cross Blue Shield of ND

- TriCare

- North Dakota Medicaid

- Medicare

- Medica

- Sanford Health Plan

- HealthPartners

- United Behavioral Health

We do not accept out-of-state Medicaid insurance plans.

While we work directly with your insurance company to process claims and clarify coverage issues, it is ultimately your responsibility to verify insurance benefits. Please call your insurance company for specific plan details regarding coverage, deductibles, and coinsurances for mental health services.

Learn How Health Insurance Works »

Patient Billing & Payments

For In Network Insurance

If we are an in-network provider for your health insurance, you won’t be billed until after we've submitted a claim to your insurance company for your services. You will receive a patient billing statement by mail for any amount not paid by insurance. This bill is due upon request and can be paid by mail, online, or in-person at Dakota Family Services.

For Out Of Network Insurance

If your insurance plan is out-of-network, we ask you to pay for services before they occur. If your out-of-network insurance then covers a portion of the bill, we will credit your account for that amount.

For any questions regarding your bill, call 701-551-7015.

No Surprises Act Rights and Protections

Private Pay

If you do not have insurance, we do accept private pay for therapy, psychiatric services, and psychological testing. When paying out-of-pocket for services, we require you to pay for services before they occur. An intake specialist will tell you how much it will cost based on the type of service(s) you receive.

How Health Insurance Works

Premium

The amount you and your employer pay each month in order to be enrolled in medical, dental, and vision insurance.

Deductible

The amount you must pay each year for covered health services before your insurance plan will begin to pay.

Out-of-Pocket Maximum

The most you will pay for covered health services during the year. Copays, deductibles, and coinsurance payments count toward the out-of-pocket maximum. Once you meet your out-of-pocket maximum, your insurance plan will pay 100% of covered health services for the remainder of the year.

Covered Health Service

Covered services are the health care services, drugs, supplies, and equipment that are covered under your health care plan. Whether or not a service is covered is dependent upon your insurance policy. Non-covered services are those you must pay out of pocket.

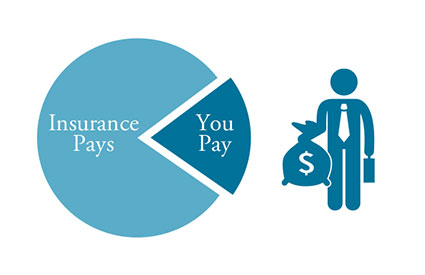

Coinsurance

After you meet your deductible, you may pay coinsurance, which is your share of the costs of a covered health care service.

For example, if your health insurance allows $200 per visit for behavioral healthcare and your coinsurance is 20%, after you meet your deductible you will pay 20% ($40) of the $200. Your insurance will pay the remaining $160.

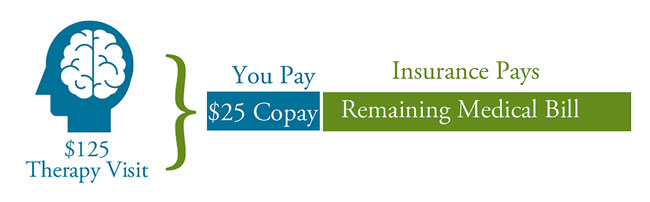

Copayment

A fixed dollar amount you pay for covered health services. Your copay is due at the time of service.

For example, your insurance may require a copay for behavioral health visits (therapy, medication management, and psychological testing).

Allowed Amount

The allowed amount is the amount your insurance carrier will pay for a covered service. It may also be called "eligible expense," "payment allowance," or "negotiated rate." For instance, if your insurance allows $125 for a service and the charge is $150, you are responsible for the remaining $25.

In Network

When a provider/facility is "in-network" with an insurance company, the provider has agreed to accept the insurance company's allowed amount for a service. These will show up as discounts on your explanation of benefits statements.

Out Of Network

When a provider/facility is "out-of-network," you are responsible for paying the difference between your insurance company's allowed amount and the provider's fee for a service.

Self Pay

When you pay out-of-pocket for services, your provider does not submit a claim to your insurance company.